Thursday, December 7, 2023

In the wake of the Israel-Gaza conflict, Mabrian Technologies, a leader in the Travel Intelligence sector, has released a Security Perception Index study shedding light on the impact of the conflict for neighbouring destinations in terms of tourism confidence.

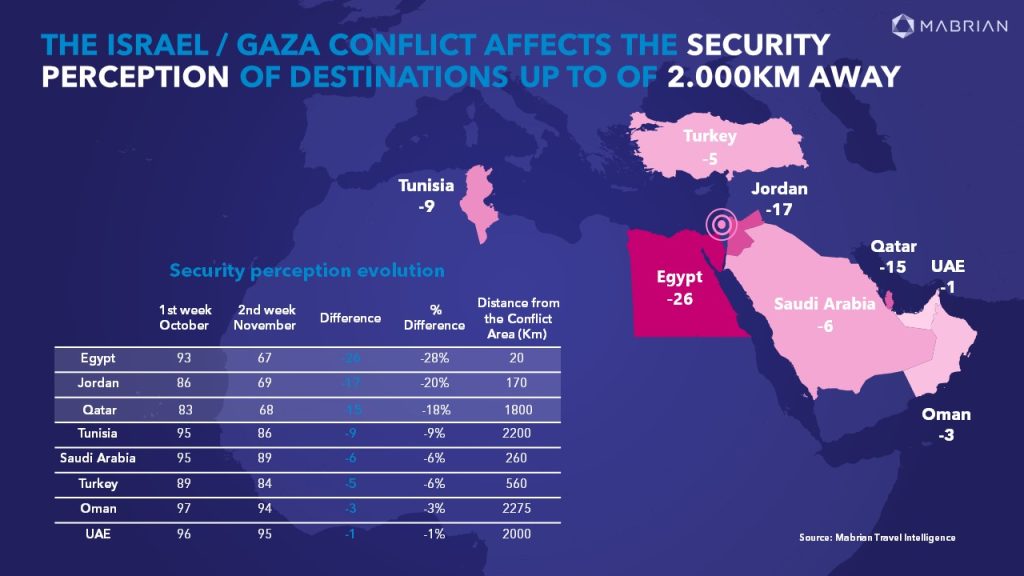

The main takeaway of the study is a significant fall in the Security Perception Index for all destinations that could be loosely defined as ‘Arab’ regardless of distance from the conflict.

The Mabrian Security Perception Index is a proprietary index that measures the level of confidence expressed by visitors and potential travelers regarding a tourist destination based upon social media monitoring. This methodology uses Artificial Intelligence (Natural Language Processing) to interpret travellers’ sentiment based on Social Media interactions.

Carlos Cendra, CMO of Mabrian, commented on the findings, emphasizing the immediate impact of conflicts on the travel sector. “Travel is one of the first industries to feel the brunt of a conflict, certainly at a national level. The Mabrian Security Perception Index is one of the most important indicators we calculate for our clients, since this is one of the key factors for tourists to visit a country or not. What use is great weather or value for money if a destination is not viewed, rightly or wrongly, as safe?

“In the case of the conflict between Israel and Hamas, we see a dramatic drop in the security perception in the destinations surrounding the conflict area. Jordan and Egypt have lost around 20% and 28% respectively in this score in the last four weeks, when compared to the week before the 7 October attacks on Israel. But the effects are also evident in Saudi Arabia, losing around 6% in its security confidence index and even in the UAE and Qatar, more than 2,000km and 1,800km away respectively from the conflict area, we can see a security perception decrease – with Qatar’s being a quite significant 18% fall.

“Tunisia, further away still and much closer by a long way to mainland Europe, is also seeing its score impacted. Whilst Turkey is not an Arab country, and for that matter nor is Egypt, nonetheless the common theme for countries seeing an impact here are those that are considered ‘Arab’ by travellers in the loosest possible sense. For example, Greece is much closer to the conflict zone than most of these countries impacted, but the perception of the security there has not altered noticeably.

“In such circumstances it is vital to understand the sensitivity of different markets towards the situation, as the scores we are giving here are an average of all the major source markets around the world and when we look on a source-market-by-source-market basis we see quite a lot of variation – so a DMO might want to pivot towards or away from certain source markets temporarily at least. Equally destinations need to set in place an efficient communication strategy to recover confidence as soon as possible, for example in the case of destinations like Tunisia finding a way to show travellers that they are at zero risk of being caught up in the conflict directly.”

Tuesday, April 30, 2024

Tuesday, April 30, 2024

Tuesday, April 30, 2024

Tuesday, April 30, 2024

Tuesday, April 30, 2024

Tuesday, April 30, 2024